Updated on by Hayley Brown

Keeping track of payments can be difficult within a large organisation, especially if your applications aren’t integrated. Whether a small business or large enterprise, billing and payment solutions can help unify processes and keep your customer information up to date.

What are billing and payment applications?

Billing and payment applications are online payment processing solutions that allow online customers to pay for goods and services quickly. As well as subscribe to a paid membership or subscription with a recurring payment.

Payment systems are APIs integrated within an eCommerce platform or website. They are triggered into action when a user places an order on the merchant’s website. This information is sent to the gateway payment, Strip for example. The Stripe API will request payment from the bank. The bank will then verify the request. The payment gateway verifies and sends the money to the merchant.

Popular Billing and Payment Applications

Typical Integration Types

There are several types of payment gateway integrations that could be used. For instance, when you need to sync and track new customer orders. As well as adjust reoccurring subscription payments, find upselling opportunities and respond to any errors.

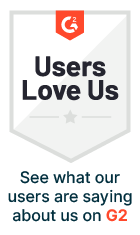

Accounting and Billing/Payment Integrations

Firstly, drawing integrations between hosted payment gateways and your financial system is vital for keeping track of payments. As well as customer invoices, and receipts as they influence regular reporting.

A useful integration is to generate an invoice once a customer subscription has been paid. The invoice can be sent via email to the customer as recognition of successful payment. Then attached to their profile in both accounting and CRM systems.

Other accounting and billing/payment integration examples:

- Receive payment information from multiple providers to a single source

- Generate receipts in accounting for new payment charges

- Add a note to a user when a new charge has been made

- Add a note to the user when a new payment method has been added to the account

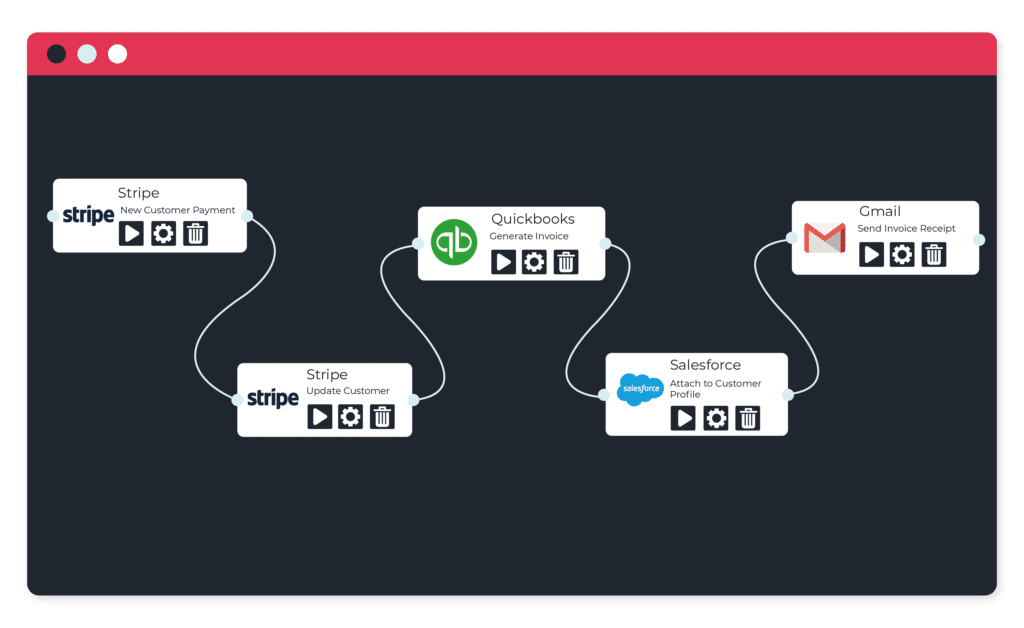

eCommerce and Billing/Payment Integrations

For an online shop billing and payment, integrations can help streamline and sync processes with other applications in your organisation.

For example, when a new subscription has been created via your website the payment integration API creates a new customer account. This information can then also be added to your CRM, or marketing applications to maintain communication with the customer.

Other eCommerce integration examples:

- Send order information to external systems for processing or notification

- Add new payment charges to eCommerce orders

- Add new customers on the eCommerce platform for new subscriptions in the billing application

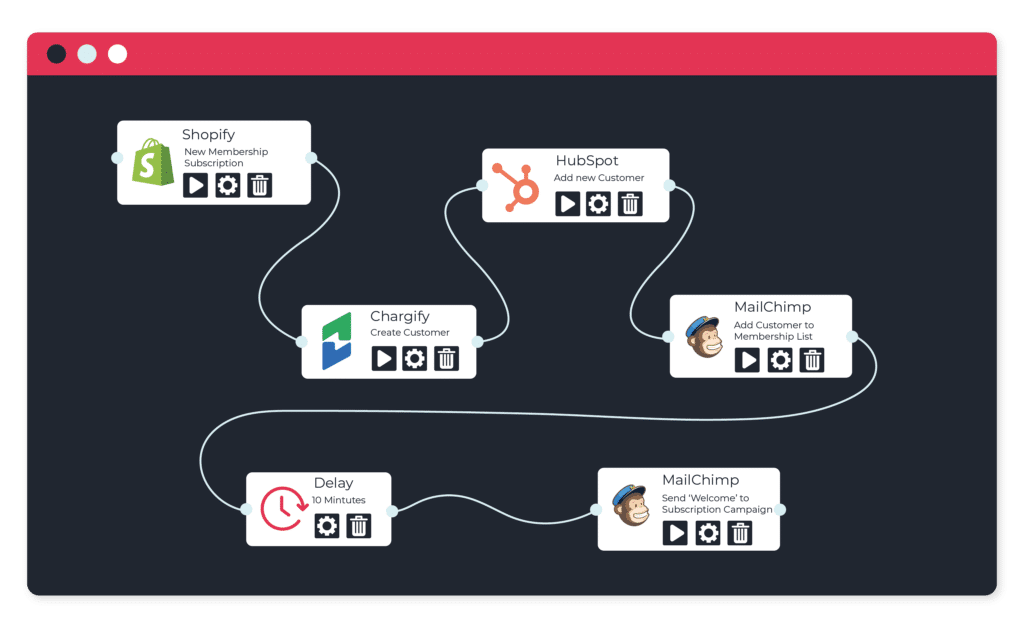

Sales and Billing/Payment Integrations

The payment integration service can also create a new customer once a new deal has been added. This is useful for sales reps to identify what customers are on certain subscription plans. With the sales tool being integrated with data tools reps can see directly see customers’ usage. As a result, they can then identify upselling opportunities.

Other sales integration examples:

- Create new sales leads for new subscribers

- From a new sale create a new membership for the customer with an add-on

- Turn quotes into sales orders and generate customer invoices

CRM and Billing/Payment Integrations

As your CRM is holding all of your customer’s data integrations be created to pull data or update it based on new information externally received.

For instance, with recurring monthly card payments, your systems can be notified if the customer’s card has expired. Alternatively, if the customer has changed their payment options, or if they have updated their card information.

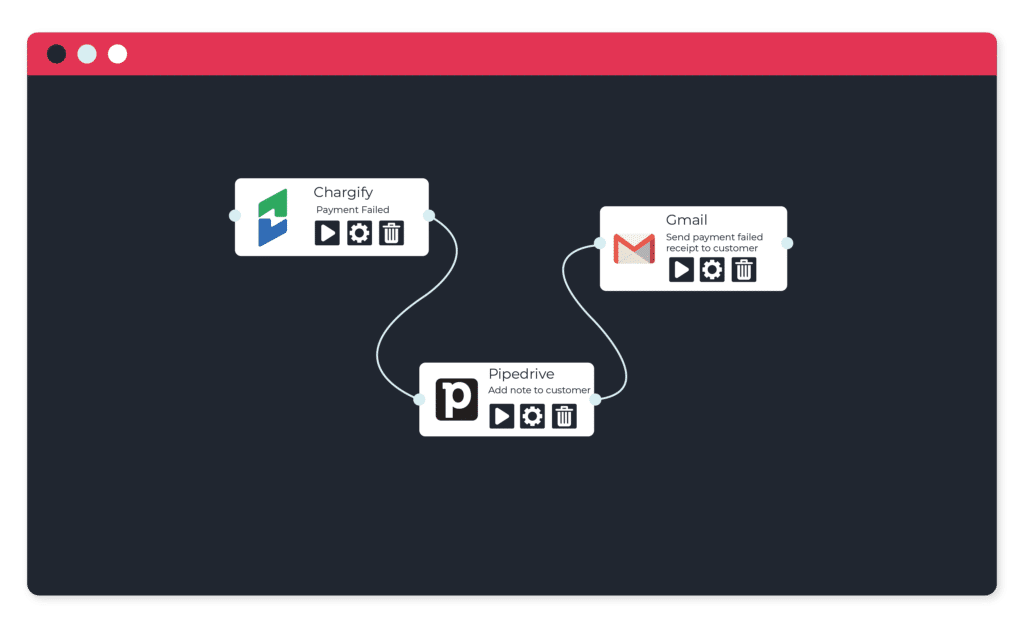

To keep track of customer payments integrations can be built to add notes to customers’ CRM profiles. These can be to indicate whether payment has failed or to trigger an email response when there are upcoming payments.

Other CRM and billing / payment integration examples:

- Create or update contact from the enrolment form in CRM

- When a membership payment has failed automatically add a note to the CRM account and email with payment failed details need updating

- Add new eCommerce billed customers to CRM as contacts

- Find existing customers and identify upsell opportunities with new products/services based on membership or tier level

How are these types of integrations beneficial for an organisation?

Building integrations between your billing and payment systems to other SaaS applications within your organisation is beneficial.

This is because they are able to provide a full customer picture in partnership with your CRM, or data tools. They allow you to sync systems and track payments. This can help influence upselling opportunities based on customer usage.

Ultimately billing and payment integrated solutions can efficiently streamline processes and keep all systems up to date.