Updated on by Hayley Brown

Finance and accounting software provides core functionality to any business. This is through the tracking of revenue, profit or loss, cash flow, and taxes as well as many other accounting features. As a result, financial data can help predict business growth, and influence business decisions.

What are accounting applications?

Accounting platforms are used to help you manage your business’s financial data. This includes invoicing, billing, subscription management, and tax. Accounting platforms can also help manage your customer’s and/or clients’ banking details, and give useful financial reports. As well as provide forecasts for future business ventures.

Accounting applications tend to have a user-friendly dashboard which is broken down into categories to easily understand your financial data. For instance sales, profits, losses, invoices etc. As well as features like reporting, SaaS integrations, inventory management, payment solutions, and bank account information. Therefore, building integrations can help keep this information as up-to-date as possible, and automate manual processes.

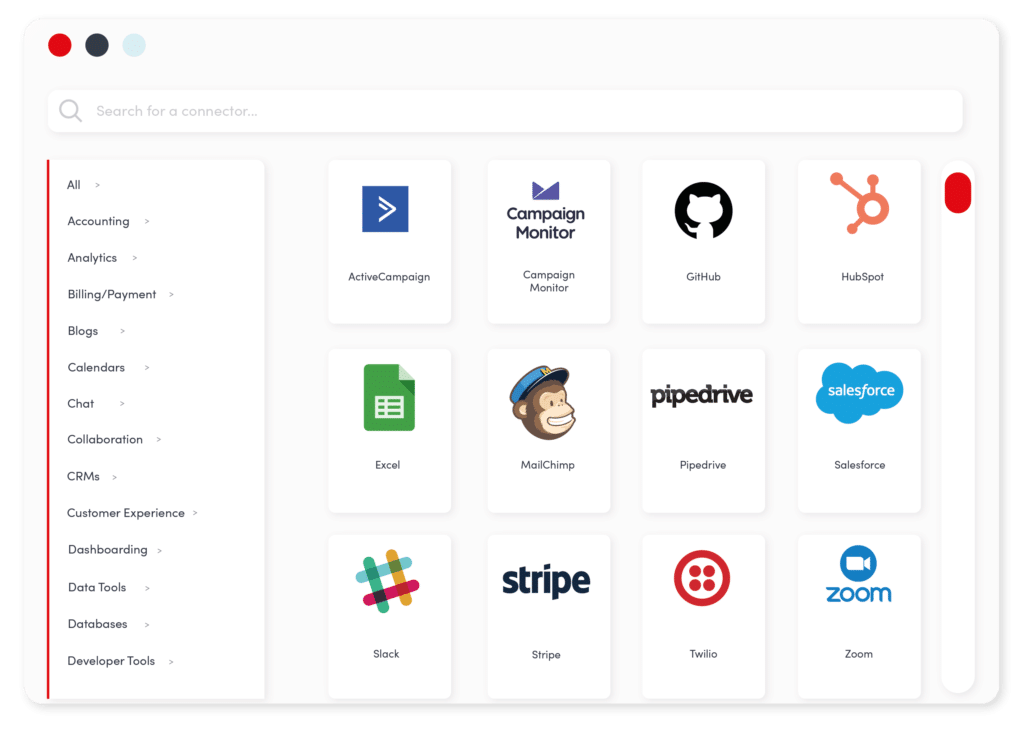

Popular Accounting Connectors

Typical Accounting Integrations

Accounting integrations are typically used to organise, manage and keep track of your business finances. In order to keep tabs on customer orders, invoices, client subscriptions, and expenses. By using low-code tools it is quick to create integrations between an accounting application and other SaaS platforms. As a result, they can be as simple or complex as you need. An integrated accounting system is designed to save you time and resources by automating manual data entry processes.

Accounting and eCommerce

A useful accounting integration is with your eCommerce platform to keep track of customer orders and invoicing. This could be via Shopify, Squarespace, WordPress and Woocommerce. These integrations enable you to create invoices and receipts for new orders placed on your site.

For example, a Shopify integration could be implemented when a new order has been placed then your accounting platform, Freshbooks for instance creates an invoice. This is then sent as a Gmail notification to the intended recipient.

Examples of Accounting and eCommerce Integrations

- Create a Freshbooks item when a new Shopify product is created

- Create a Freshbooks sale receipt from a new Shopify order

Accounting and Communication

Another accounting platform integration could be with your communication application. Integrations could be enabled for when a new customer has been added to Quickbooks. Resulting in a message being sent to your sales Slack channel to follow up with the new customer, or invoice.

For instance, the Quickbooks integration could look something like a message being sent to your communication platform Slack when a new event has occurred in Quickbooks. This could be a successful customer payment or a payment failure that needs to be followed up.

Examples of Accounting and Communication Integrations

- Send new invoices in Quickbooks to Slack

- Send customer subscription payment reminders via Gmail

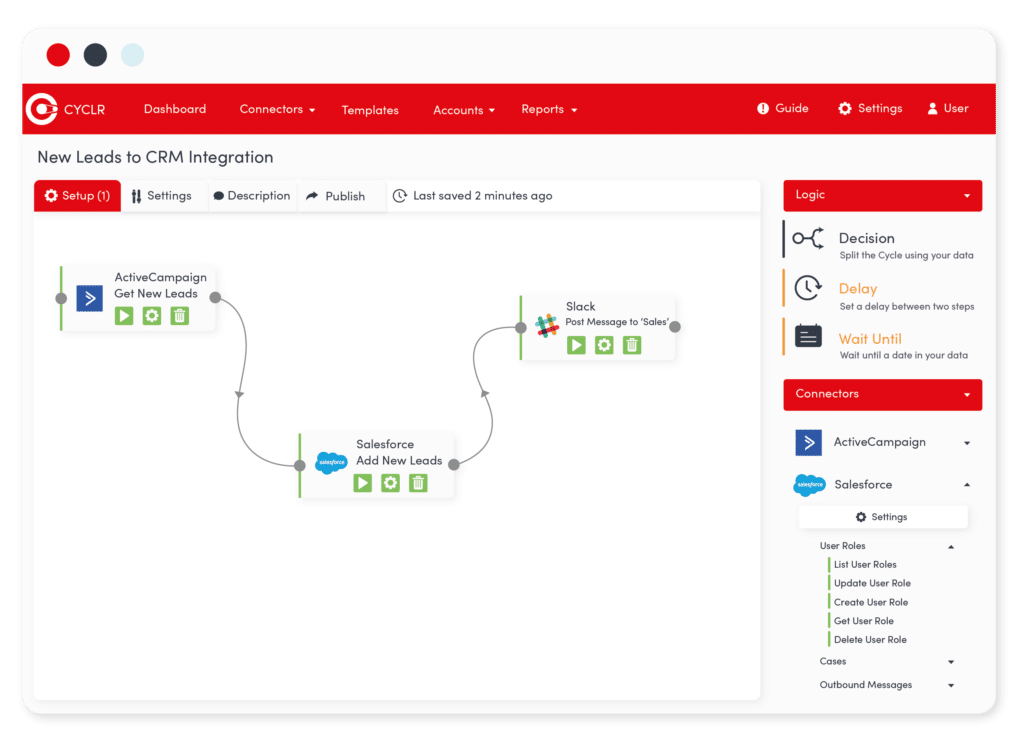

Learn more about Cyclr

Accounting and Databases

Accounting and databases seem to go hand in hand so connecting them via an integration can automate any data entry required. The data could be in the form of customer details, customer orders, or month-on-month financial reporting.

A useful integration could be used to generate a sales receipt in Chargify from customer details in a Google Sheets spreadsheet.

Examples of Accounting and Database Integrations

- Save new Chargify invoices to a Google Sheets spreadsheet

- Save new Chargify customers to a Google Sheets spreadsheet

Accounting and CRM

An integration between your accounting application and CRM is useful for keeping your customer data up to date. It can also build a client profile for future purchases, and provide cross-selling opportunities, or subscription management.

An integration could consist of updating accounts in Salesforce upon successful payment via Sage. When a payment is successful, the integration could ask to get more information about the subscription. Then check to see if an account exists in Salesforce. If one does update the account, if not add the account.

Examples of Accounting & CRM Integrations

- Attach invoices/receipts from Sage to the customer account on Salesforce

- Add customer order information from Sage to Salesforce

Accounting & Sales

From a sales, perspective integrations are vital for financial reporting. Whether this is done on a monthly, quarterly or yearly basis. Integrations between your sales SaaS and your accounting applications allow you to continuously collect and monitor real-time sales. As well as revenue and spending data in one interface.

For instance, an integration can run when a new deal has been added to Pipedrive with the customer’s information. It can then trigger an account being created in Quickbooks. Then a delayed report on the cash flow from deals that day.

Examples of Accounting & Sales Integrations

- When a deal is won, automatically send the customer invoices, track the payment and begin the fulfilment process

- At the end of the month, an integration can produce a profit/loss report from the past 30 days of sales

Why are accounting integrations beneficial to your business?

Ultimately finance and accounting integrations are beneficial to your business because they work together to streamline processes. They improve the flow of financial data, reduce any human error from manual data entry, and save operational resources. Automated reports and visual dashboards help to predict business performance, KPI decisions and upcoming budgets.

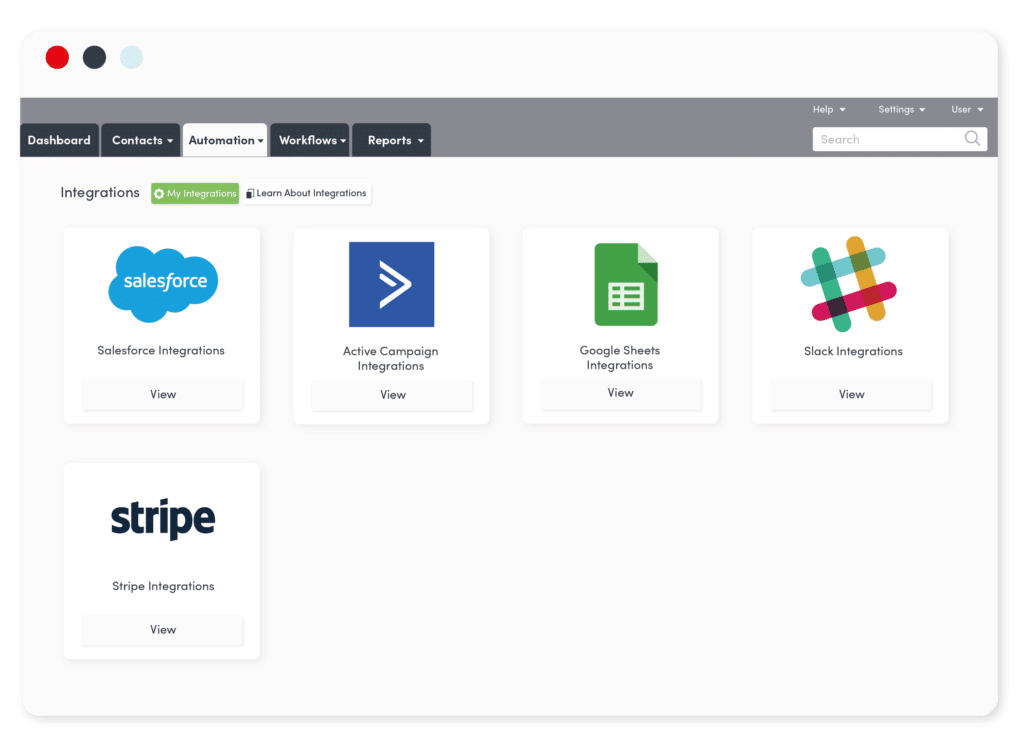

An embedded iPaaS can help your SaaS ecosystem, where your accounting application sits. With useful integrations to keep your financial data flowing through the right platforms.